Refund Choices with ID

Your school utilizes our disbursements program

to deliver your refund & provide your official school ID card

When it comes to deciding how to get your money, you deserve choices. Please hold on to the card in your refund selection kit; this card is required for on-campus use.

Your refund choices include:

Deposit to an existing account

Money is transferred to an existing account the same business day we receive funds from your school. Typically, it takes 1 – 2 business days for the receiving bank to credit the money to your account (upon identity verification).

Deposit to a BankMobile

Checking Account

Money is deposited the same business day we receive funds from your school, if you open a BankMobile Checking Account (upon identity verification).

At some schools, a paper check option may be available.

Look for your personal code. There are multiple ways you can get a code:

- EMAIL: We will send you an email with your code.

- MAIL: You may receive a green envelope in the mail. If so, it will be sent to the address you have on file with your school.

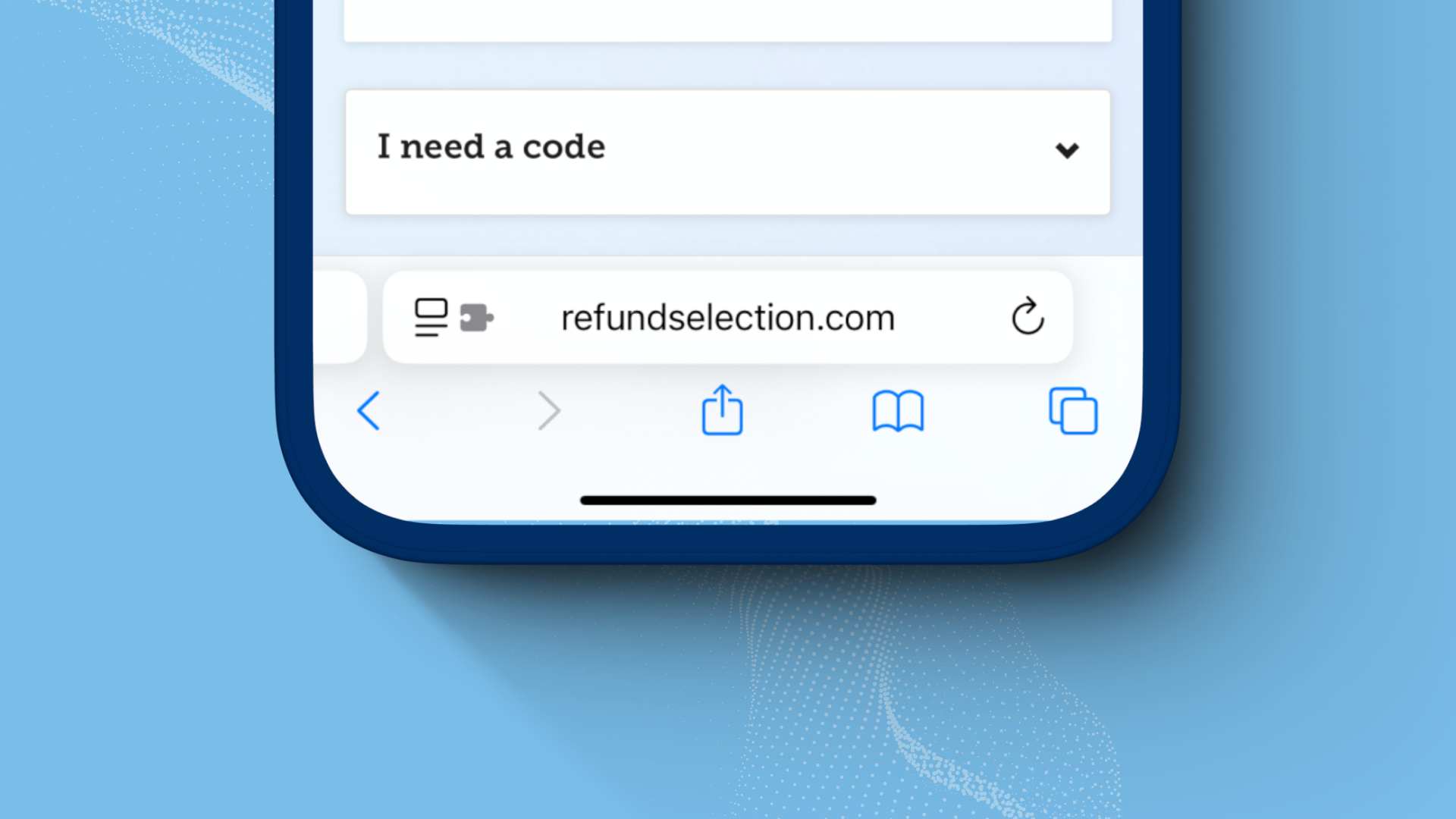

- ON DEMAND: Visit RefundSelection.com and click on the “I need a code” link. You may use any personal code assigned to you to make your refund preference selection.

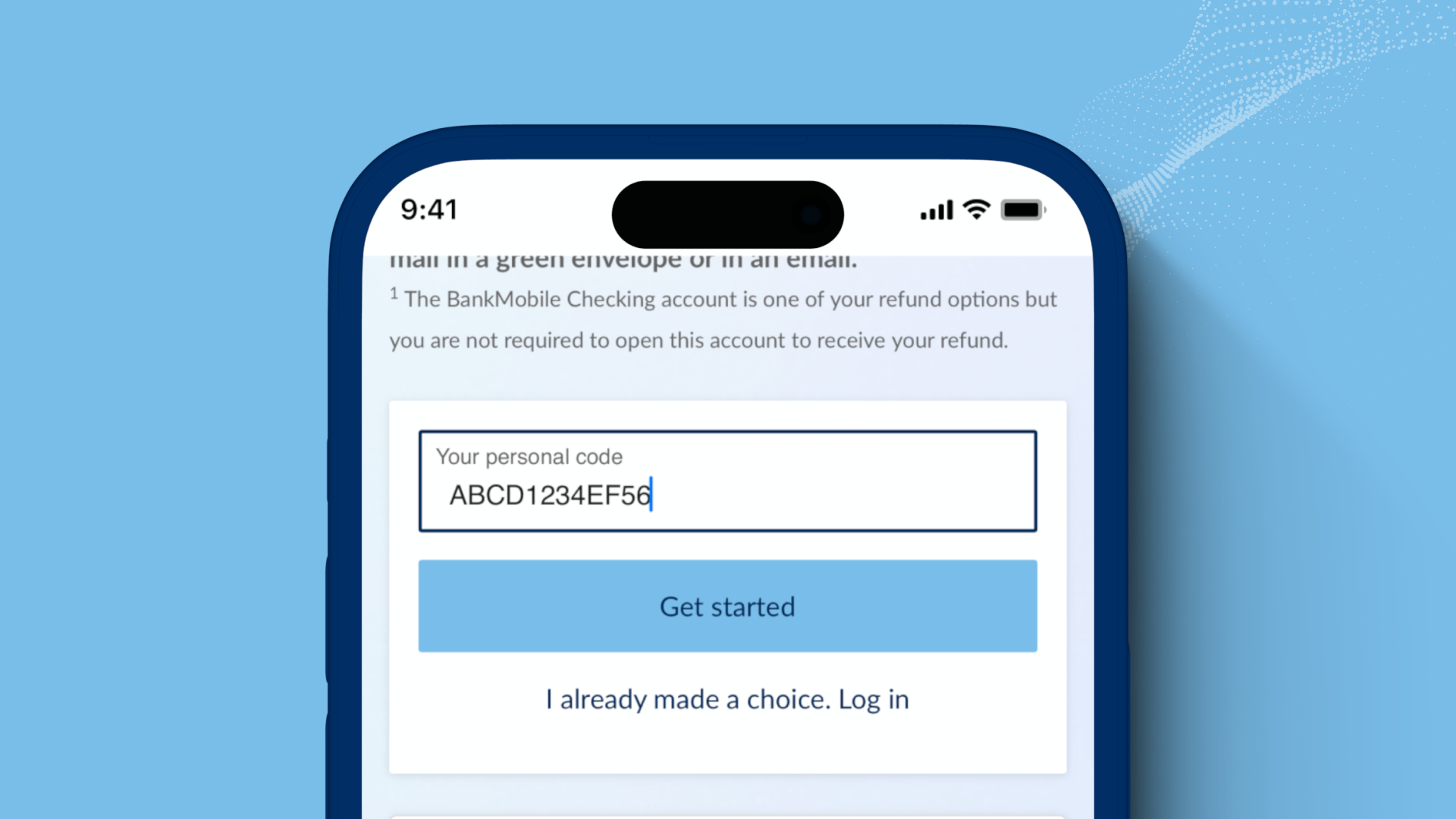

- Once you have your code, follow these easy steps:

Step 2

ENTER your unique personal code.

Step 3

SELECT how you’d like to receive your money.

Don’t have your personal code?

Get one here under the “I need a code” section.

Are you due a refund?

If you don’t receive financial aid, you still may receive money back from the school in the future. After all, you may drop a class or make an overpayment. Going through this process now can ensure you’ll receive any money owed to you by your school in a timely manner.

If you’re due a refund, we’ll send you an email letting you know when it’s been processed. You can also have refund alerts sent directly to your mobile phone. Signing up is easy:

1. Log in to your profile

2. Under the ‘User Profile’ tab, select ‘Mobile Alerts’

3. Follow the prompts (Message and data rates may apply, please see your provider for details.)

FAQs

The most common type of money we disburse to students are funds left over from financial aid awards, loans, or grants after tuition has been paid. Students receiving these funds have usually requested this additional support to help with books and living expenses. Other types of money may include reimbursement for tuition overpayment or a dropped class. We use the term “refund,” but your school may have another name for these funds, such as a disbursement, residual, or stipend.

You will use your personal code to make your refund selection at RefundSelection.com.

There are multiple ways you can get a code:

MAIL: Look out for the mailed envelope. Your code will be sent to the address you have on file with your school.

EMAIL: We will send you an email with your code.

ON DEMAND: Visit RefundSelection.com and click on the "I need a code" link.

You may use any personal code assigned to you to make your refund preference selection.

Delivery of refund money is a multi-step process. First, your school draws funds from the respective loan and/or grant provider and applies it to your student account. Once this information is verified by your school, it is sent to us. Once the specific refund information and funds are received, it is processed and disbursed according to your selection.

Yes. Just log in to RefundSelection.com and select “Refund Preferences” from the “Refund” menu option. Once on the page, simply make your new selection and click the “Update Preference” button to complete the process. Be aware that your new selection will only affect future money you receive from your school.

Please note, there may be circumstances where your ability to change your refund preference may be restricted. For example, if we become aware of potential ID theft or compromised account.

We send you an email to the address you entered during setup or you can view the status of your refund online at RefundSelection.com.

The BankMobile Checking Account is a digital-only, FDIC-insured checking account with access to 55,000 fee-free Allpoint® ATMs (ATM availability varies by location). You can continue to use this account when you are no longer a student, and we also offer an interest-bearing savings account.

Yes. The BankMobile Checking Account has a $2.99 monthly service fee; however, you may avoid this fee by making Qualifying Deposits totaling $300 or more per statement cycle. Qualifying Deposits include direct deposit, transfers from external bank accounts, check deposits, point-of-sale deposits and cash deposits such as those made via Green Dot® Reload @ the Register™. Financial aid refunds or other refunds issued by your school, interest earned on your account, promotional credits such as cash back awards, internal account transfers, fee waivers, fee credits, returned items or dispute credits are not eligible toward the $300 in total deposits. For more information, see the BankMobile Checking Account Fee Schedule and Interest Rate Information and Account Terms and Conditions.

Get easy answers anytime by using our online FAQ database

Visit RefundSelection.com

Call Customer Care: 1-877-327-9515

Twitter: @askbmd

Facebook: @bankmobiledisbursementsfaqs

Learn more about the BankMobile Checking Account

The BankMobile Checking Account offers the power to bank anywhere, anytime. This is one of your electronic options to receive your refund.

We assist students in reaching their financial goals through the BankMobile Savings Account.

Allpoint® ATMs

Say goodbye to ATM fees, thanks to over 55,000 fee-free Allpoint ATMs (ATM availability varies by location).

Debit Card On/Off Switch

Temporarily turn off your card to help protect against unauthorized use in the event your card is misplaced.

Cash Back Offers

Automatically earn cash back on BankMobile Debit Card purchases from merchants you know and love at 40,000+ online locations and 12,000+ local locations.

Bill Pay

Make bill-paying faster, easier and more secure. With Online Bill Pay, you can:

• Set up recurring payments

• Manage Bill Pay recipients

• View payment history